If you’ve been following crypto’s US regulatory journey, you know that in January 2024, crypto took a giant step closer to more widespread adoption when the SEC approved BlackRock, Grayscale, and nine other firms’ spot bitcoin Exchange Traded Funds (ETFs) in long-awaited SEC decision.

Just as you got your head around futures vs. spot ETFs, crypto TwitterX is abuzz with the news that the London Stock Exchange is moving ahead with crypto ETN approval later this year. The Financial Conduct Authority (FCA), the UK financial regulatory body, gave the London Stock Exchange the green light on ether and bitcoin Exchange Traded Notes (ETNs).

In March, the LES released a “Crypto ETN Admission Fact Sheet” to provide guidelines for financial institutions interested in submitting proposals. Among other stipulations, the LES will limit the ETNs to professional investors.

But what exactly are Crypto ETNs, and how do they differ from Bitcoin ETFs? Will the ETN launch impact the marketplace differently from the SEC’s approval of ETFs? Why would savvy crypto investors choose one over the other?

Let’s take a look.

ETFs vs. ETNs: A Breakdown

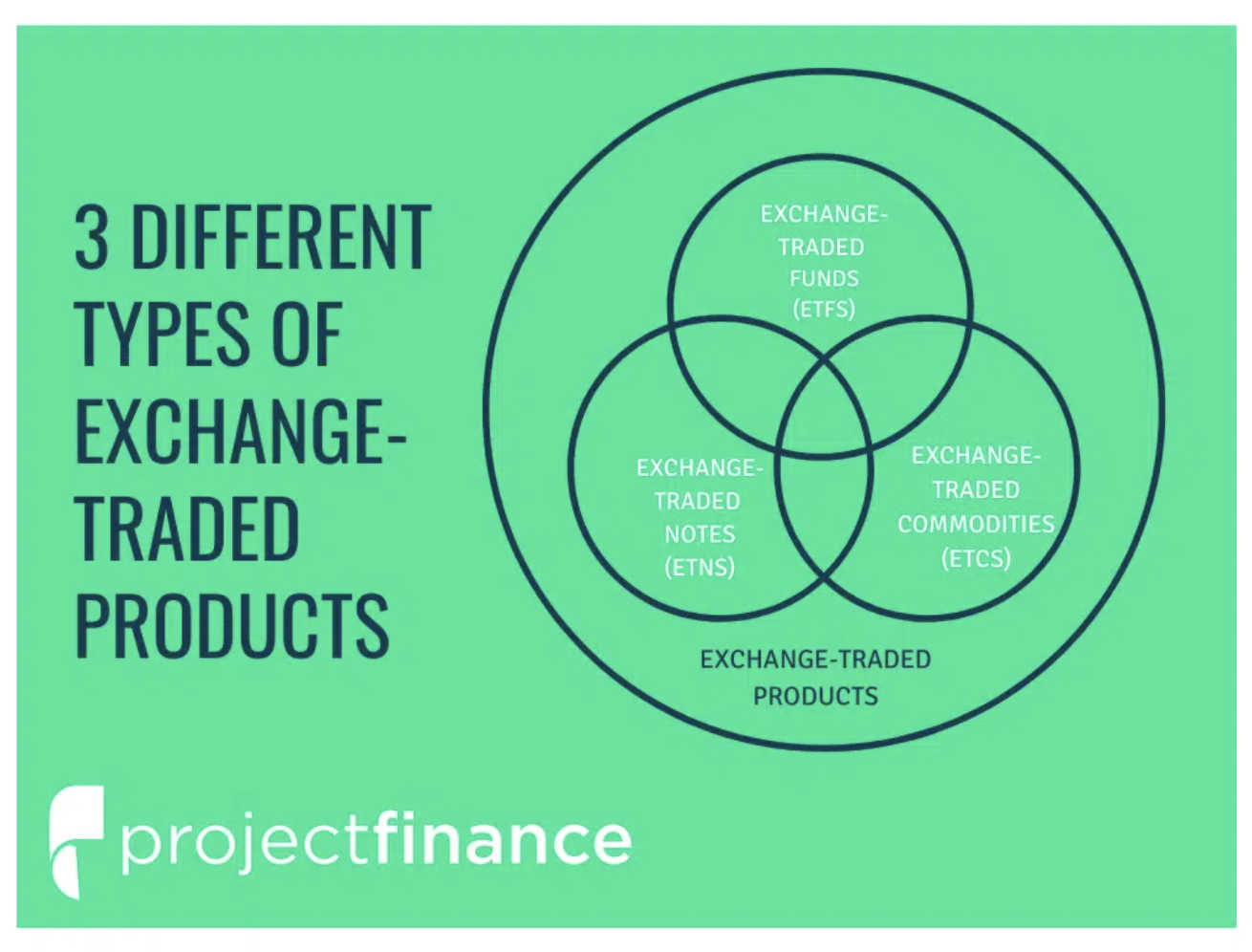

If the proliferation of financial “ETs” has you feeling like an alien stole your brain, you aren’t alone. ETFs and ETNs are part of a broader category of what traders and the financial press call Exchange-Traded Products (ETPs). Although this post doesn’t cover them, Exchange-Traded Commodities (ETCs) are also in this category.

While their core principles remain similar to the TradFi versions, crypto introduces new layers of complexity and risk. Let’s look at some comparisons of ETFs vs. ETNs with a crypto twist.

Exchange-Traded Funds (ETFs)

ETFs remain baskets of various securities, but in the context of crypto, they would likely hold a basket of established cryptocurrencies or derivatives related to them.

Types of Crypto ETFs

Crypto Spot ETFs directly hold the underlying cryptocurrencies. For example, a spot Bitcoin ETF potentially offers more direct exposure to the crypto market but also introduces BTC’s inherent volatility. While traditionally considered less risky than Futures ETFs, the high volatility of cryptocurrencies could make spot Crypto ETFs more dangerous in this specific context.

Crypto Futures ETFs track the performance of cryptocurrencies through futures contracts. This approach might offer protection against the high daily fluctuations of crypto prices. Still, it also introduces tracking error (the difference between the ETF’s performance and the underlying asset) and potential leverage risks associated with futures contracts.

Investor Benefits of Crypto ETFs

Exposure to Crypto Market. ETFs offer a convenient way to gain exposure to the crypto market without the complexities of managing individual crypto wallets or dealing with security risks.

Potential for Diversification. Depending on the basket composition, ETFs could offer diversification within the crypto asset class itself.

Crypto Exchange-Traded Notes (ETNs)

ETNs for crypto would function similarly to traditional ETNs. They are debt securities issued by a financial institution that tracks the performance of an underlying crypto asset (like bitcoin) but doesn’t hold the crypto itself.

How Are Crypto ETNs Different From TradFi?

Their core structure wouldn’t be fundamentally different from traditional ETNs. However, the underlying asset (cryptocurrency) introduces a new layer of risk due to its inherent volatility and the potential for regulatory uncertainty surrounding the crypto market.

Investor Benefits of Crypto ETNs

Here are some reasons why investors are interested in crypto ETNs:

Access to Crypto Market: Similar to ETFs, ETNs offer a way to gain exposure to crypto without directly managing the assets.

Potential Tax Benefits: Depending on the structure, ETNs might offer some tax advantages compared to directly investing in cryptocurrencies.

The Impact of Crypto ETN Approval on Global Markets

While the full impact of the LSE launch of crypto ETNs remains a question, here are some of the takeaways for investors at this point:

- The LSE sees a competitive advantage in expanding its offerings: By allowing Bitcoin ETNs, it provides investors with a familiar and regulated way to gain exposure to Bitcoin.

- ETNs track Bitcoin price. These notes function similarly to traditional ETNs, tracking the price of Bitcoin but not directly holding the cryptocurrency itself.

- Focus on security. The LSE requires physically backed (non-leveraged) ETNs with the underlying Bitcoin stored securely in cold storage or equivalent measures.

- Growing demand for Bitcoin. The decision reflects the increasing interest from traditional investors and institutions seeking exposure to Bitcoin.

- Evolving regulatory landscape. Improved regulatory clarity makes institutions more comfortable offering Bitcoin-related products.

The LSE’s move is a significant development in crypto’s journey to mainstream finance. While initially limited to professional investors, ETNs signify marketplace momentum to make Bitcoin more accessible through established financial institutions. It also highlights the ongoing evolution of the regulatory landscape surrounding cryptocurrencies.

Crypto ETF or ETN: Which Is Best for You?

Choosing between a crypto spot ETF and ETN depends on your investment goals and risk tolerance. A crypto spot ETF might be a better fit if your primary objective is direct exposure to the underlying asset and you hope to benefit from significant price increases.

If you’re looking for a less volatile way to gain exposure to crypto and possible tax advantages (depending on the structure), an ETN could be an option. Remember, with ETNs, you’re relying on the issuer’s creditworthiness, so do your research on the issuing institution.

Here are some additional considerations:

Volatility. Cryptocurrencies are known for their high price swings, and this volatility is probably the SEC’s main objection to significantly expanding crypto ETFs.

Regulation. The regulatory landscape surrounding crypto is still evolving and could impact the availability and features of crypto ETFs and ETNs.

Issuer Risk. With both ETFs and ETNs, you’re relying on the creditworthiness of the issuing institution.

While ETFs and ETNs offer potential benefits for accessing the crypto market, they come with additional risks due to the inherent volatility and regulatory uncertainty surrounding cryptocurrencies. Carefully consider your risk tolerance and investment goals before venturing into this space.

Moving Ahead with Crypto ETN Approval Potential

EFTs and ETNs may not immediately impact the casual crypto user or the average investor. The road to crypto integration is costly – with high regulatory agency fees, legal teams, and dozens of delays. We’re watching a fascinating process of incredibly wealthy TradFi institutions bulldozing the way to greater crypto acceptance.

What do you think? What’s next for crypto and Tradfi?

If you invest in crypto, ZenLedger can help you stay organized for tax time. If you trade crypto assets, ZenLedger can help you stay organized for tax time regardless of the regulatory landscape.

Our platform automatically aggregates transactions across your wallets and exchanges, computes your capital gain or loss, and generates the paperwork you need to file. This paperwork includes personal tokens you issue or purchase and the income or loss they generate.

The above is for general info purposes only and should not be interpreted as professional advice. Please seek independent legal, financial, tax, or other advice specific to your particular situation.